|

| diagram A AEX open between now-1993 |

|

| Diagram B |

statistics about diagram B

N 6138

Min 99.76

Max 702.09

Sum 2105687

Mean 343.0576

Std. error 1.922163

Variance 22678.13

Stand. dev 150.5926

Median 336.42

25 prcntil 212.755

75 prcntil 453.86

Skewness 0.2810237

Kurtosis -589.7686

Geom. mean 306.8134

N 6138

Min 99.76

Max 702.09

Sum 2105687

Mean 343.0576

Std. error 1.922163

Variance 22678.13

Stand. dev 150.5926

Median 336.42

25 prcntil 212.755

75 prcntil 453.86

Skewness 0.2810237

Kurtosis -589.7686

Geom. mean 306.8134

Shapiro-Wilk W 0.9642

p(normal) 1.699E-36

Jarque-Bera JB 207.4

p(normal) 9.023E-46

p(Monte Carlo) 0.0001

Chi^2 87.061

p(normal) 1.0523E-20

p(normal) 1.699E-36

Jarque-Bera JB 207.4

p(normal) 9.023E-46

p(Monte Carlo) 0.0001

Chi^2 87.061

p(normal) 1.0523E-20

Here above in diagram B is the real graph from 1-1-1990 until now, all in euros.

It goes now as well as it was back in june 1997 and oct 1997 and aug 2002 and july 2005 and july 2008 when the stock-exchange hit around the 390 mark as it does today!

The red line shows the difference between closing and openingvalues, lets call that the amplitude.

It goes now as well as it was back in june 1997 and oct 1997 and aug 2002 and july 2005 and july 2008 when the stock-exchange hit around the 390 mark as it does today!

The red line shows the difference between closing and openingvalues, lets call that the amplitude.

|

| amplitude of stock- exchange richter scale |

|

| magnitude (x-axis) vs. amplitude (y-axis) |

Some after-shocks still may occur.

magnitude

statistics on difference high-low (the magnitude) at same day AEX

N 6138

Min 0

Max 46.38

Sum 29930.74

Mean 4.876302

Std. error 0.0549919

Variance 18.56198

Stand. dev 4.308362

Median 3.81

25 prcntil 1.76

75 prcntil 6.72

Skewness 1.975364

Kurtosis -2523.784

Geom. mean 0

5483 points are less then 10.0 on the stock exchange quakescale which corresponds with 89.328% of all 6138 points

6084 points are less then 20.0 on the stock exchange quakescale and equals to 99.12% of all points

6128 points are less then 30.0 on the scale and equals 99.837% of all points

6137 less then 40.0 thus 99.98%

1 greater then 40.0 and corresponds with 0.016%

The epicentra of the quakes above 30.0 are in order of magnitude ascending:

(all dates: mm-dd-yyyy)

3/16/2003

8/5/2002

9/28/2008

1/14/1999

1-6-1999

10/27/1997

9/16/2001

1/21/2008

9/13/2001

9/10/2001 equals with +46.38 points

9/13/2001 charged -32

9/28/2008 charged -30.67

1/22/2008 charged -25.37

1-6-1999

9/16/2008 charged -23.58

4/26/1998

7/14/2002

1/20/2008 charged -21.96

1-3-2000

8/14/1997

9/19/2001

1-12-1999

7/28/2002

7/16/2002

10/14/2002

8-5-2002

3/16/2003

10/27/1997

1/21/2008 charged 29.22

1/14/1999 with a charge of +30.94

The worst day in stock-exchange history from the last 23 years could be 10 sept 2001 and that's during the internet-bubble with a fall of -8.25% or -37.15 points. But on 28 sept 2008 the fall of -30.67 points equaled -9.48%. On 16 march 2003 the biggest difference between high and low was recorded at 11% or 30.08 points.

Because the sum of amplitudes and also the sum of % are both negative it is advisable not to bet on the AEX, it can be negative because the differences between close and open that are not on the same day isn't accounted for in these calculations!

The stats for the difference for close and open with a night in between for two adjecent days (the night-amplitude) are:

N 6137

Min -39.3

Max 21.55

Sum 727.2

Mean 0.1184944

Std. error 0.0381782

Variance 8.94514

Stand. dev 2.990843

Median 0.12

25 prcntil -0.885

75 prcntil 1.24

Skewness -0.8369069

Kurtosis -4123.689

Geom. mean 0

The epicentra during these nights

for less then -20 points in ascending order:

10/27/1997 equals with -39.3

4/16/2000

6/25/2002

9/20/2001

8/31/1998

8/27/1998

10-9-2008 equals a charge of -20.29

Night amplitudes in percentage:

N 6137

Min -12.58889%

Max 6.277155%

Sum 141.7944%

Mean 0.02310484%

Std. error 0.01041881%

Variance 0.6661817%.

Stand. dev 0.8161996%

Median 0.04757751%

25 prcntil -0.2922083%

75 prcntil 0.3995718%

Skewness -1.368573%

Kurtosis -5153.1

Geom. mean 0

The internet bubble-height equals about 702 points and the height of the housing bubble is 563 points which is about 80% of the first bubble, just not a fibonacci number, but their angle is.

The ratio of the two bears is also a fibonacci ratio -364.13/-476.72=0.764 !!

Note to self: recommended reading

DATAsource: yahoo finance

Remark: due to a stocksplit by the introduction of the euro on 4 jan 1999 on the AEX the given marketvalues by Yahoo are skewed but are in this article exchanged to euros.

N 6138

Min 0

Max 46.38

Sum 29930.74

Mean 4.876302

Std. error 0.0549919

Variance 18.56198

Stand. dev 4.308362

Median 3.81

25 prcntil 1.76

75 prcntil 6.72

Skewness 1.975364

Kurtosis -2523.784

Geom. mean 0

|

| curve of the magnitude |

5483 points are less then 10.0 on the stock exchange quakescale which corresponds with 89.328% of all 6138 points

6084 points are less then 20.0 on the stock exchange quakescale and equals to 99.12% of all points

6128 points are less then 30.0 on the scale and equals 99.837% of all points

6137 less then 40.0 thus 99.98%

1 greater then 40.0 and corresponds with 0.016%

The epicentra of the quakes above 30.0 are in order of magnitude ascending:

(all dates: mm-dd-yyyy)

3/16/2003

8/5/2002

9/28/2008

1/14/1999

1-6-1999

10/27/1997

9/16/2001

1/21/2008

9/13/2001

9/10/2001 equals with +46.38 points

amplitude

statistics for difference close-open at same day AEX

N 6138

Min -37.15

Max 30.94

Sum -476.34

Mean -0.07760508

Std. error 0.05318578

Variance 17.36272

Stand. dev 4.16686

Median 0

25 prcntil -1.45

75 prcntil 1.52

Skewness -0.3243027

Kurtosis -2641.157

Geom. mean 0

negative charged:

3 points are less then -30.0

13 points are less then -20.0

130 points are less then -10.0

5902 points are between or equal of -10.0 and 10.0 and corresponds with 96.155% of al charges.

positive charged:

Min -37.15

Max 30.94

Sum -476.34

Mean -0.07760508

Std. error 0.05318578

Variance 17.36272

Stand. dev 4.16686

Median 0

25 prcntil -1.45

75 prcntil 1.52

Skewness -0.3243027

Kurtosis -2641.157

Geom. mean 0

3 points are less then -30.0

13 points are less then -20.0

130 points are less then -10.0

5902 points are between or equal of -10.0 and 10.0 and corresponds with 96.155% of al charges.

positive charged:

106 points are greater then 10.0

9 points are greater then 20.0

1 point is greater then 30.0

every point smaller then -20.0 has in ascending order the location:

9-10-2001 with a charge of -37.159/13/2001 charged -32

9/28/2008 charged -30.67

1/22/2008 charged -25.37

1-6-1999

9/16/2008 charged -23.58

4/26/1998

7/14/2002

1/20/2008 charged -21.96

1-3-2000

8/14/1997

9/19/2001

1-12-1999

and every point greater then 20.0 has in ascending order the location:

12/2/19987/28/2002

7/16/2002

10/14/2002

8-5-2002

3/16/2003

10/27/1997

1/21/2008 charged 29.22

1/14/1999 with a charge of +30.94

|

| amplitude in % |

|

| histogram of amplitude in % |

stats of % from closingvalues

N 6138

Min -9.479215%

Max 8.822873%

Sum -135.1495%

Mean -0.02201849%

Std. error 0.01404136%

Variance 1.210167%

Stand. dev 1.100076%

Median 0

25 prcntil -0.4646779%

75 prcntil 0.490223%

Skewness -0.3059599

Kurtosis -2797.77

Geom. mean 0

|

| % amplitude (y-axis) vs. % magnitude (x-axis) |

Because the sum of amplitudes and also the sum of % are both negative it is advisable not to bet on the AEX, it can be negative because the differences between close and open that are not on the same day isn't accounted for in these calculations!

The stats for the difference for close and open with a night in between for two adjecent days (the night-amplitude) are:

N 6137

Min -39.3

Sum 727.2

|

| night-amplitude |

Std. error 0.0381782

Variance 8.94514

Stand. dev 2.990843

Median 0.12

25 prcntil -0.885

75 prcntil 1.24

Skewness -0.8369069

Kurtosis -4123.689

Geom. mean 0

The epicentra during these nights

for less then -20 points in ascending order:

10/27/1997 equals with -39.3

4/16/2000

6/25/2002

9/20/2001

8/31/1998

8/27/1998

10-9-2008 equals a charge of -20.29

Towards a conclusion.

The cause of these stock-exchange quakes may be the friction between nighttime trade and daytime trade plates, is my suspicion. Moerover only 8 out of 39 or 20% of the dates reffer to the 2008 housing bubble and the rest to the 2001 internet bubble, the deepest fall was a -12.59% at 27 oct 1997, followed on second place by 10 sept 2008 with a -8.41%.

The bottom of the housingbubble in 10 march 2009 (199.34 points) was slightly deeper then the bottom (225.37 points) of the bear of the intenetbubble in 10 march 2003. The top of the internet-bubble was 702.09 (4 sep 2000) and the top of the housing-bubble was 563.47 (12 july 2007), all figures at the AEX.

(The peak of the NASDAQ was on a 10 march 2000 with 5408.60 points.)

The difference between top and low of the internet bubble is 702.09-225.37=-476.72 points spread over 638 workingdays.

The difference between the top and low of the housingbubble is -364.13 points (bear) spread over 424 workingdays.

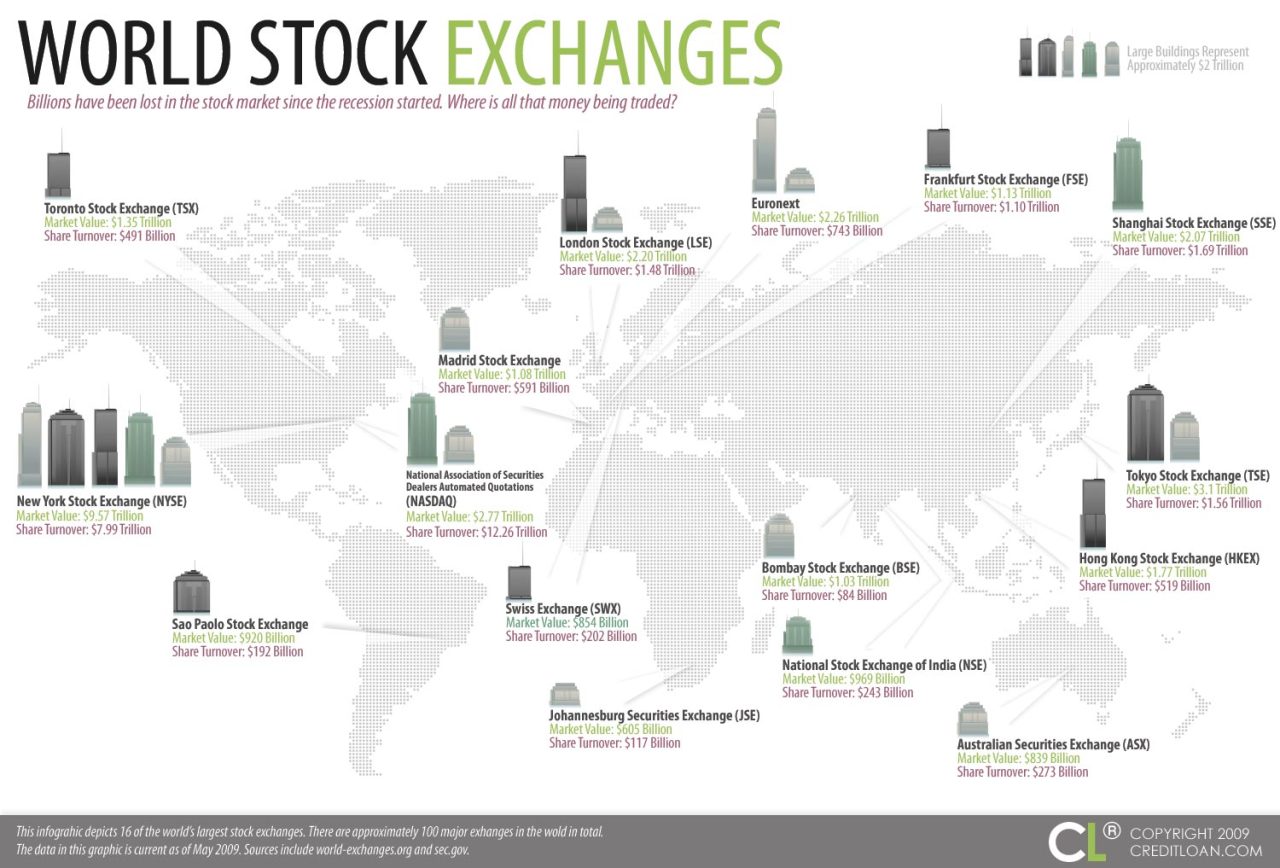

The sum of the night-amplitude is -40.6 points over 423 nights and the sum of the day-amplitude is -323.53 points over 424 days, so only -12.549% of the -364.13 points from the housing-bubble bear happened during our nights, hence -87.541% of the housing bear can only be but shared by some stock-exchanges on the other side of the planet but within 8 hours distance. And since the pacific has no stock-exchange outside 8 hours from us except the japanese (TSE) and australian (ASX) they alone are responsible for that -12.549%.

Not quite the paradigm-shift but is in here somewhere.

The bottom of the housingbubble in 10 march 2009 (199.34 points) was slightly deeper then the bottom (225.37 points) of the bear of the intenetbubble in 10 march 2003. The top of the internet-bubble was 702.09 (4 sep 2000) and the top of the housing-bubble was 563.47 (12 july 2007), all figures at the AEX.

(The peak of the NASDAQ was on a 10 march 2000 with 5408.60 points.)

The difference between top and low of the internet bubble is 702.09-225.37=-476.72 points spread over 638 workingdays.

The difference between the top and low of the housingbubble is -364.13 points (bear) spread over 424 workingdays.

The sum of the night-amplitude is -40.6 points over 423 nights and the sum of the day-amplitude is -323.53 points over 424 days, so only -12.549% of the -364.13 points from the housing-bubble bear happened during our nights, hence -87.541% of the housing bear can only be but shared by some stock-exchanges on the other side of the planet but within 8 hours distance. And since the pacific has no stock-exchange outside 8 hours from us except the japanese (TSE) and australian (ASX) they alone are responsible for that -12.549%.

Not quite the paradigm-shift but is in here somewhere.

N 6137

Min -12.58889%

Max 6.277155%

Sum 141.7944%

Mean 0.02310484%

Std. error 0.01041881%

Variance 0.6661817%.

Stand. dev 0.8161996%

Median 0.04757751%

25 prcntil -0.2922083%

75 prcntil 0.3995718%

Skewness -1.368573%

Kurtosis -5153.1

Geom. mean 0

The total sum of the day-amplitude and the sum of the night-amplitude over 6138 dates add eachother up to +250.86 and that add up with the first open 1-1-1990 (136.52) and that accounts for the last close of 387.38 at 9 dec 2013; the sum of their percentages add up to +6.6449%

visual analysis

The ratio of the two bears is also a fibonacci ratio -364.13/-476.72=0.764 !!

DATAsource: yahoo finance

Remark: due to a stocksplit by the introduction of the euro on 4 jan 1999 on the AEX the given marketvalues by Yahoo are skewed but are in this article exchanged to euros.